Sentiment surrounding Bitcoin (BTC) remains optimistic as the leading cryptocurrency continues to trade comfortably above the $61k level. In fact, recent data suggests that the outlook could improve even further.

This positive trend is fueled by the strong possibility of a golden crossover—a bullish technical pattern—that could drive the coin’s price even higher.

Bitcoin’s impending golden crossover.

Data from CoinMarketCap showed that BTC bulls dominated the market last week, pushing the coin’s price up by over 7%. At the time of writing, BTC was trading at $64,003.47 with a market capitalization exceeding $1.2 trillion.

While bullish momentum held strong, Ali, a well-known crypto analyst, highlighted a significant development in a recent tweet. According to the tweet, BTC’s MVRV ratio and its 365-day simple moving average (SMA) were nearing a crossover.

If this crossover occurs, BTC could experience another bull rally, potentially driving its price even higher.

To assess the likelihood of this golden crossover, AMBCrypto conducted a deeper analysis using Glassnode’s data. The analysis revealed that BTC’s price may have already hit its market bottom, as indicated by the Pi Cycle Top indicator.

If the golden crossover happens, BTC could soon rally towards its potential market peak of $103k.

The path forward for BTC

Our analysis of CryptoQuant’s data indicated that BTC’s exchange reserves were on the rise, signaling increased selling pressure. Additionally, BTC’s active addresses dropped by 39.25% compared to the previous day, while the total number of transactions also fell by 25.39%. Both metrics suggest a bearish outlook for Bitcoin.

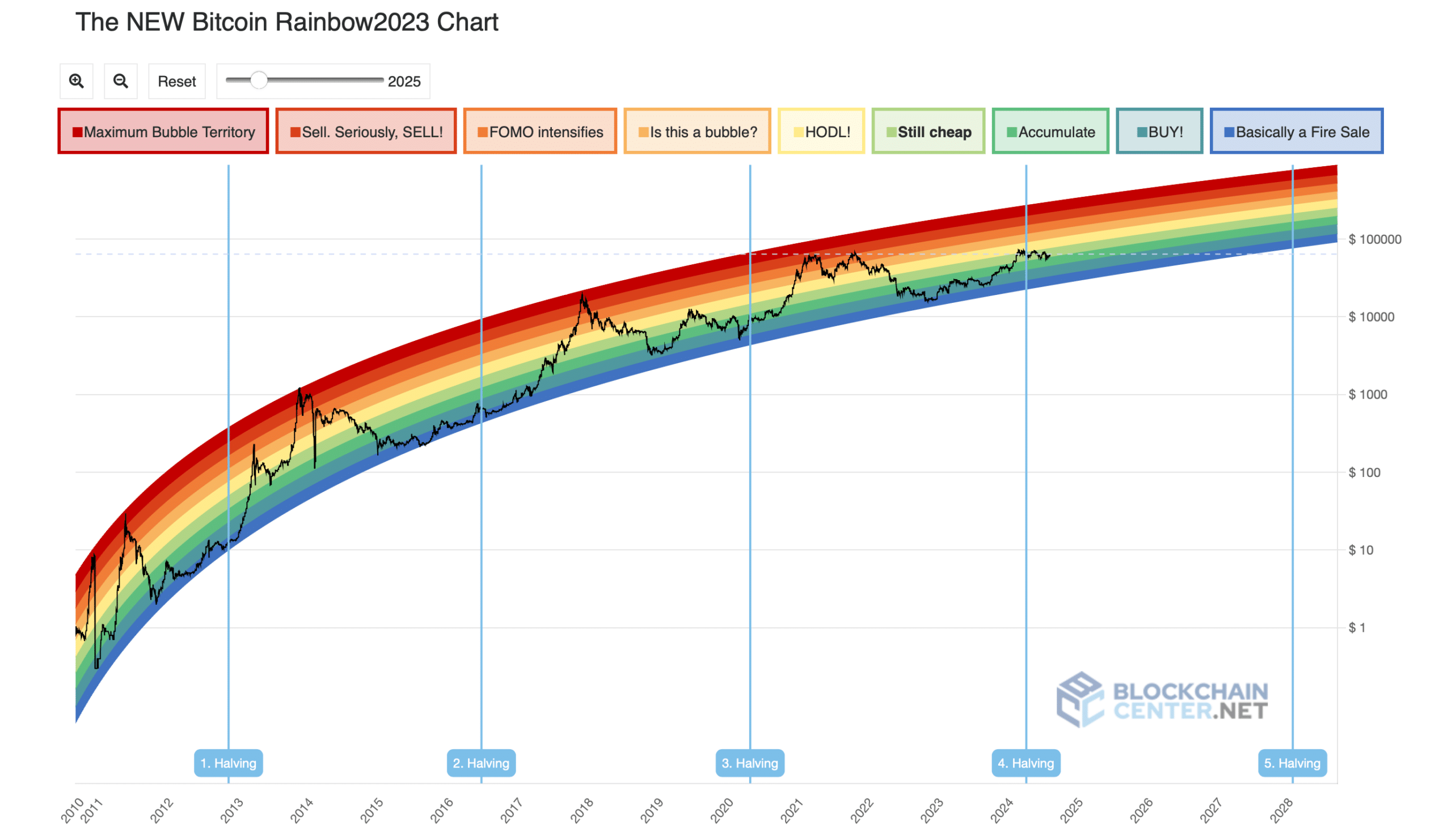

The bearish sentiment extended to the derivatives market, where a red taker buy/sell ratio highlighted that selling pressure was dominant in the futures market. However, the Bitcoin Rainbow Chart suggests there’s still a buying opportunity. The chart currently places BTC’s price in the “still cheap” zone, implying that investors might consider accumulating before the price surges.

To gain further insight, we examined BTC’s daily chart, where market indicators presented mixed signals. The Relative Strength Index (RSI) showed a sharp upward movement before stabilizing, indicating uncertainty in the market’s next direction.

Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin’s price was $59,430.79 at this time last week. Over the past seven days, it has risen by 9.28%, currently standing at $64,112. However, in the last 24 hours, BTC has dipped slightly by 0.09%, reflecting a mild bearish sentiment in the crypto market. Despite this short-term downturn, the long-term outlook remains bullish, with projections suggesting BTC could reach $102,808.17 by 2025.

As of writing, Bitcoin’s circulating supply stands at 19,745,187, with a market capitalization of $1,265,696,410,464. Looking further ahead, Bitcoin’s price is anticipated to reach a potential high of $300,850.19 by 2035.

Bitcoin (BTC) is projected to reach $89,994.79 in 2024. In the most bearish scenario, BTC could be valued at $51,289.60, while the most optimistic outlook predicts a price of $89,994.79 for the year. Bitcoin’s previous all-time high occurred on March 14, 2024, when it peaked at $73,738.